Package Version Citation

1 afex 1.1.1 @afex

2 base 4.2.2 @base

3 correlation 0.8.4 @

4 easystats 0.6.0.8 @easystats

5 emmeans 1.8.0 @emmeans

6 equatiomatic 0.3.1 @equatiomatic

7 flair 0.0.2 @flair

8 GGally 2.1.2 @GGally

9 gganimate 1.0.8 @gganimate

10 ggeffects 1.3.2 @ggeffects

11 ggpmisc 0.5.0 @ggpmisc

12 ggstatsplot 0.9.4 @ggstatsplot

13 gt 0.8.0 @gt

14 huxtable 5.5.0 @huxtable

15 insight 0.19.6 @insight

16 kableExtra 1.3.4 @kableExtra

17 knitr 1.41 @knitr2014; @knitr2015; @knitr2022

18 olsrr 0.5.3 @olsrr

19 pacman 0.5.1 @pacman

20 papaja 0.1.1.9001 @papaja

21 parameters 0.21.1.2 @parameters

22 patchwork 1.1.2 @patchwork

23 performance 0.10.4.1 @performance

24 ppcor 1.1 @ppcor

25 pwr 1.3.0 @pwr

26 report 0.5.7.9 @report

27 rmarkdown 2.14 @rmarkdown2018; @rmarkdown2020; @rmarkdown2022

28 see 0.8.0.2 @see

29 skimr 2.1.4 @skimr

30 supernova 2.5.6 @supernova

31 tidyverse 1.3.2 @tidyverse

32 ungeviz 0.1.0 @ungeviz

33 WebPower 0.9.4 @WebPower

34 xaringan 0.26 @xaringan

35 xaringanExtra 0.7.0 @xaringanExtra

36 xaringanthemer 0.4.1 @xaringanthemerMultiple Regression

Princeton University

2023-11-26

Packages

Today

Introduction to multiple regression

- Interpretation of coefs

Assumptions of multiple regression

Effect size and power

Plotting

Write-up

Simple Linear Model

Multiple predictors in linear regression

Multiple regression

\[\begin{align} \hat{Y} &= b_0 + \beta_1 X \end{align}\]

\[\large \hat{Y} = b_0 + b_1X_1 + b_2X_2 + \dots+b_kX_k\]

- Simple as adding predictors to our linear equation

Multiple regression equation

\[\large \hat{Y} = b_0 + b_1X_1 + b_2X_2 + \dots+b_kX_k\]

- \(\hat{Y}\) = predicted value on the outcome variable Y

- \(b_0\) = predicted value on Y when all Xs = 0

- \(X_k\) = predictor variables

- \(b_k\) = unstandardized regression coefficients

- \(k\) = the number of predictor variables

Straight Line to Hyperplane

More than two predictors (plane)

- Multi-dimensional space

Regression coefficients are “partial” regression coefficients

Slope for variable X1 (\(b_1\)) predicts the change in Y per unit X1 holding X2 constant

Slope for variable X2 (\(b_2\)) predicts the change in Y per unit X2 holding X1 constant

Multiple Regression: Example

\[ \begin{align*} \operatorname{CESD\_total} &= b_o + b_{1}(\operatorname{PIL\_total}) \\ &+ b_{2}(\operatorname{AUDIT\_TOTAL\_NEW}) \\ &+ b_{3}(\operatorname{DAST\_TOTAL\_NEW}) \\ &+ e \end{align*} \]

master <- read.csv("https://raw.githubusercontent.com/jgeller112/psy503-psych_stats/master/static/slides/10-linear_modeling/data/regress.csv")

head(master) X PIL_total CESD_total AUDIT_TOTAL_NEW DAST_TOTAL_NEW

1 1 121 28 1 0

2 2 76 37 5 0

3 3 98 20 3 0

4 4 122 15 3 1

5 5 99 7 2 0

6 6 134 7 3 0Mental Health and Drug Use:

- CESD = depression measure

- PIL total = measure of meaning in life

- AUDIT total = measure of alcohol use

- DAST total = measure of drug usage

Scatterplot

Scatterplot

Scatterplot

Individual Predictors

We test the individual predictors with a t-test:

\(t = \frac{b}{SE}\)

Therefore, the model for each individual predictor is our coefficient b

Single sample t-test to determine if the b value is different from zero

Fitting the model

model_fit <- lm(CESD_total ~ PIL_total + AUDIT_TOTAL_NEW + DAST_TOTAL_NEW,

data = master)

summary(model_fit)

Call:

lm(formula = CESD_total ~ PIL_total + AUDIT_TOTAL_NEW + DAST_TOTAL_NEW,

data = master)

Residuals:

Min 1Q Median 3Q Max

-19.619 -5.172 -1.256 3.420 28.847

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 55.16374 3.88905 14.184 <2e-16 ***

PIL_total -0.38158 0.03384 -11.276 <2e-16 ***

AUDIT_TOTAL_NEW -0.09211 0.09391 -0.981 0.328

DAST_TOTAL_NEW 1.03415 0.39871 2.594 0.010 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 7.585 on 262 degrees of freedom

(1 observation deleted due to missingness)

Multiple R-squared: 0.3587, Adjusted R-squared: 0.3513

F-statistic: 48.84 on 3 and 262 DF, p-value: < 2.2e-16| term | estimate | std.error | statistic | p.value | conf.low | conf.high |

|---|---|---|---|---|---|---|

| (Intercept) | 55.1637359 | 3.8890461 | 14.1843873 | 0.0000000 | 47.5059719 | 62.8214999 |

| PIL_total | -0.3815778 | 0.0338406 | -11.2757330 | 0.0000000 | -0.4482119 | -0.3149436 |

| AUDIT_TOTAL_NEW | -0.0921089 | 0.0939109 | -0.9808116 | 0.3275905 | -0.2770251 | 0.0928073 |

| DAST_TOTAL_NEW | 1.0341539 | 0.3987126 | 2.5937324 | 0.0100281 | 0.2490649 | 1.8192429 |

\(b_0\): The value of Y when all the Xs=0

Fitting the model

| term | estimate | std.error | statistic | p.value | conf.low | conf.high |

|---|---|---|---|---|---|---|

| (Intercept) | 55.1637359 | 3.8890461 | 14.1843873 | 0.0000000 | 47.5059719 | 62.8214999 |

| PIL_total | -0.3815778 | 0.0338406 | -11.2757330 | 0.0000000 | -0.4482119 | -0.3149436 |

| AUDIT_TOTAL_NEW | -0.0921089 | 0.0939109 | -0.9808116 | 0.3275905 | -0.2770251 | 0.0928073 |

| DAST_TOTAL_NEW | 1.0341539 | 0.3987126 | 2.5937324 | 0.0100281 | 0.2490649 | 1.8192429 |

\(b_1\): If Alch and drug use are held constant, for every 1 unit increase in X (meaning) leads to a -0.38 decrease in depression scores.

Fitting the model

| term | estimate | std.error | statistic | p.value | conf.low | conf.high |

|---|---|---|---|---|---|---|

| (Intercept) | 55.1637359 | 3.8890461 | 14.1843873 | 0.0000000 | 47.5059719 | 62.8214999 |

| PIL_total | -0.3815778 | 0.0338406 | -11.2757330 | 0.0000000 | -0.4482119 | -0.3149436 |

| AUDIT_TOTAL_NEW | -0.0921089 | 0.0939109 | -0.9808116 | 0.3275905 | -0.2770251 | 0.0928073 |

| DAST_TOTAL_NEW | 1.0341539 | 0.3987126 | 2.5937324 | 0.0100281 | 0.2490649 | 1.8192429 |

\(b_2\): Holding meaning and drug use constant, for every unit increase in alch use there is a -0.09 decrease in depression scores.

Fitting the model

| term | estimate | std.error | statistic | p.value | conf.low | conf.high |

|---|---|---|---|---|---|---|

| (Intercept) | 55.1637359 | 3.8890461 | 14.1843873 | 0.0000000 | 47.5059719 | 62.8214999 |

| PIL_total | -0.3815778 | 0.0338406 | -11.2757330 | 0.0000000 | -0.4482119 | -0.3149436 |

| AUDIT_TOTAL_NEW | -0.0921089 | 0.0939109 | -0.9808116 | 0.3275905 | -0.2770251 | 0.0928073 |

| DAST_TOTAL_NEW | 1.0341539 | 0.3987126 | 2.5937324 | 0.0100281 | 0.2490649 | 1.8192429 |

\(b_3\): Holding meaning and alch usage constant, for every unit increase in drug usage there is a 1.03 increase in depression.

Mo predictors mo problems

Assumptions

Linearity

Independence

Normality of residuals

Equal error (“homoskedasticity”)

Issues:

Missingness

Factors are correlated with one another (multicollinearity)

Unusual values/outliers

Problems

- Missingness

- list-wise deletion (removes entire row where missingness occurs)

Problems

Multicolinearity

You want X and Y to be correlated

You do not want the Xs to be highly correlated

Multicolinearity

Problems

Extreme cases (complete collinearity) = Nonidentifiable model

“Unstable” regression coefficients (“bouncing betas”)

- Imprecise estimation

Large standard errors

- Increased Type II errors

- Not detecting a difference when there is one

- Increased Type II errors

Multicolinearity

Tolerance

- Measures influence of one predictor on another

- If predictors are highly correlated, tolerance gets smaller

\[Tolerance=1- R^2_j\]

where \(R^2_j\) is the proportion of variation in X that is explained by the linear combination of the other predictors in the model

Multicolinearity

VIF (variance inflation factor)

- How much does our estimates (SEs) change due to the correlation

\[VIF=\frac{1}{1- R^2_j}\]

Rule of thumb:

- VIF > 10 indicates issues

Multicolinearity

- Check multicolinearity in your data

Multicolinearity

Strategies

Anticipate collinearity issues at the design stage

Depends: Drop variable if there’s no theoretical pay-off anyway

Depends: Fit separate models and compare fit

Depends: Increase sample size

Depends: Orthogonalize predictors experimentally

Depends: Use alternative approaches, such as ridge regression or LASSO

Do not do anything about it (if prediction is your goal)

Identifying unusual cases

Influential points

- An observation or case is influential if removing it substantially changes the coefficients of the regression model

Influence = Leverage x Distance (outliers)

Influential points

Influential points have a large impact on the coefficients and standard errors used for inference

- Can be on x or y variables

These points can sometimes be identified in a scatterplot if there is only one predictor variable

- This is often not the case when there are multiple predictors

We will use measures to quantify an individual observation’s influence on the regression model

- Leverage, Standardized residuals , and Cook’s distance

Leverage

- Deals with Xs

Measure of geometric distance of the observation’s predictor point (\(X_{i1}\), \(X_{i2}\)) from center point of the predictor space

\[ h_i = \dfrac{1}{n} + \dfrac{\left(x_i -\overline{x}\right)^2}{\sum_{j=1}^{n}{\left(x_j -\overline{x}\right)^2}} \qquad \text{and}\qquad \overline{h} = \dfrac{k}{n} \qquad \text{and}\qquad \dfrac{1}{n} \leq h_i \leq 1.0 \]

Note

In multiple regression \(h_i\) measures distance from the centroid (point of means) of Xs

Leverage

Leverage

- We say a point is high leverage if:

\[ h_i > \frac{2K+2}{N} \]

K is the number of predictors

N is the sample size

k <- 3 ##number of IVs/predictors

# label 1 if out 0 if not

model_out<- model_fit %>%

augment() %>%

mutate(lev_out = ifelse(.hat>(2*+2)/nrow(.),1, 0))

model_out# A tibble: 266 × 12

.rownames CESD_total PIL_total AUDIT_TOTAL_NEW DAST_TOTAL_NEW .fitted .resid

<chr> <dbl> <dbl> <dbl> <int> <dbl> <dbl>

1 1 28 121 1 0 8.90 19.1

2 2 37 76 5 0 25.7 11.3

3 3 20 98 3 0 17.5 2.51

4 4 15 122 3 1 9.37 5.63

5 5 7 99 2 0 17.2 -10.2

6 6 7 134 3 0 3.76 3.24

7 7 27 102 2 1 17.1 9.91

8 8 10 124 1 0 7.76 2.24

9 9 9 126 1 0 6.99 2.01

10 10 8 112 7 1 12.8 -4.82

# ℹ 256 more rows

# ℹ 5 more variables: .hat <dbl>, .sigma <dbl>, .cooksd <dbl>,

# .std.resid <dbl>, lev_out <dbl>Standardized Residuals

- Distance

- how far away y point is from line

\[ std.res_i = \frac{y_i - \hat{y}_i}{\hat{\sigma}_\epsilon\sqrt{1-h_i}} \]

Where \(\hat{\sigma}_\epsilon\) is regression standard error

- Use cut-off > 3

Standardized Residuals

Leverage and Distance

Montoya

Leverage and distance

Montoya

Leverage and distance

Montoya

Cook’s distance

Influence (Cook’s Distance)

A measure of how much of an effect that single case has on the whole model

How close it lies to general line (residuals)

It’s leverage \[ D_i = \frac{(std.res_i)^2}{k + 1}\bigg(\frac{h_i}{1-h_i}\bigg) \]

Threshold:

\[ \frac{4}{N-K-1} \]

Cook’s distance

Combine Metrics

What do I do with all these numbers?

Create a total score for the number of indicators a data point has

You can decide what rule to use, but a suggestion is 2 or more indicators is an outliers

# label 1 if out 0 if not

model_out<- model_fit %>%

augment() %>%

mutate(lev_out = ifelse(.hat>(2*k+2)/nrow(.),1, 0), cook_out = ifelse(.cooksd > (4 / (nrow(.) - 3 - 1)), 1, 0), std_out=ifelse(.std.resid >= 3, 1, 0)) %>%

rowwise() %>%

mutate(sum_out=lev_out+cook_out+std_out) %>%

filter(sum_out < 2)

nrow(nomiss)[1] 266[1] 255Easystats: Check_outliers

Use consensus method

- If half of methods say point is outlier, get rid of it

# will estimate all outliers methods

outliers_list <- check_outliers(model_fit, method = "all")

# provides a col called outliers with prob of outliers by method (50% more than half said ob was outlier)

out_data <-insight::get_data(model_fit)[outliers_list, ] # Show outliers data

# get rid of values in outliers list in the main dataset

clean_data <- anti_join(nomiss,out_data, by=c("CESD_total", "PIL_total", "AUDIT_TOTAL_NEW", "DAST_TOTAL_NEW"))Refit model

Assumptions

Linearity

Independence

Normality of residuals

Equal error (“homoskedasticity”)

- Additivity (more than one variable)

Assumptions

Additivity

Implies that for an existing model, the effect of a predictor on a response variable (whether it be linear or non-linear) is not affected by changes in other existing predictors

- Add interaction if not the case

Assumptions

Violation Assumptions

Normality (more on this next week)

Homoskedasticity

Heteroskedasticity

Warning: Heteroscedasticity (non-constant error variance) detected (p = 0.001).We can use robust SEs

They work by changing the covariance matrix (the diagonal is the variance)

\[ \text{Var}(\epsilon) = \sigma^2 I_n = \sigma^2 \begin{bmatrix} 1 & 0 & \cdots & 0 \\ 0 & 1 & \cdots & 0 \\ \vdots & \vdots & \ddots & \vdots \\ 0 & 0 & \cdots & 1 \end{bmatrix} \]

Heteroskedasticity

\[ D_{\text{HC3}} = \begin{bmatrix} \frac{\epsilon_1^2}{(1-h_{11})^2} & 0 & \cdots & 0 \\ 0 & \frac{\epsilon_2^2}{(1-h_{22})^2} & \cdots & 0 \\ \vdots & \vdots & \ddots & \vdots \\ 0 & 0 & \cdots & \frac{\epsilon_n^2}{(1-h_{nn})^2} \end{bmatrix} \]

library(easystats) # model_paramters function

#fit model first then read into function

mp <- model_parameters(model_fit, vcov = "HC3")

mpParameter | Coefficient | SE | 95% CI | t(256) | p

-----------------------------------------------------------------------

(Intercept) | 57.65 | 4.16 | [49.45, 65.84] | 13.85 | < .001

PIL total | -0.40 | 0.04 | [-0.47, -0.33] | -11.32 | < .001

AUDIT TOTAL NEW | -0.10 | 0.09 | [-0.28, 0.07] | -1.18 | 0.240

DAST TOTAL NEW | 0.89 | 0.48 | [-0.06, 1.84] | 1.85 | 0.066 Refit Model

- Fit model on clean dataset with outliers removed

| Parameter | Coefficient | SE | CI | CI_low | CI_high | t | df_error | p |

|---|---|---|---|---|---|---|---|---|

| (Intercept) | 57.6453027 | 4.1612337 | 0.95 | 49.4506937 | 65.8399117 | 13.852935 | 256 | 0.0000000 |

| PIL_total | -0.4017946 | 0.0354963 | 0.95 | -0.4716965 | -0.3318927 | -11.319347 | 256 | 0.0000000 |

| AUDIT_TOTAL_NEW | -0.1030182 | 0.0874974 | 0.95 | -0.2753246 | 0.0692882 | -1.177385 | 256 | 0.2401352 |

| DAST_TOTAL_NEW | 0.8902347 | 0.4822412 | 0.95 | -0.0594303 | 1.8398998 | 1.846036 | 256 | 0.0660414 |

\(b_1\):

Interpretation

| Parameter | Coefficient | SE | CI | CI_low | CI_high | t | df_error | p |

|---|---|---|---|---|---|---|---|---|

| (Intercept) | 57.6453027 | 4.1612337 | 0.95 | 49.4506937 | 65.8399117 | 13.852935 | 256 | 0.0000000 |

| PIL_total | -0.4017946 | 0.0354963 | 0.95 | -0.4716965 | -0.3318927 | -11.319347 | 256 | 0.0000000 |

| AUDIT_TOTAL_NEW | -0.1030182 | 0.0874974 | 0.95 | -0.2753246 | 0.0692882 | -1.177385 | 256 | 0.2401352 |

| DAST_TOTAL_NEW | 0.8902347 | 0.4822412 | 0.95 | -0.0594303 | 1.8398998 | 1.846036 | 256 | 0.0660414 |

\(b_2\):

Interpretation

| Parameter | Coefficient | SE | CI | CI_low | CI_high | t | df_error | p |

|---|---|---|---|---|---|---|---|---|

| (Intercept) | 57.6453027 | 4.1612337 | 0.95 | 49.4506937 | 65.8399117 | 13.852935 | 256 | 0.0000000 |

| PIL_total | -0.4017946 | 0.0354963 | 0.95 | -0.4716965 | -0.3318927 | -11.319347 | 256 | 0.0000000 |

| AUDIT_TOTAL_NEW | -0.1030182 | 0.0874974 | 0.95 | -0.2753246 | 0.0692882 | -1.177385 | 256 | 0.2401352 |

| DAST_TOTAL_NEW | 0.8902347 | 0.4822412 | 0.95 | -0.0594303 | 1.8398998 | 1.846036 | 256 | 0.0660414 |

- \(b_3\):

Predictors

$estimate

$estimate$Intercept

[1] "$b = 57.65$, 95\\% CI $[49.82, 65.47]$"

$estimate$PIL_total

[1] "$b = -0.40$, 95\\% CI $[-0.47, -0.33]$"

$estimate$AUDIT_TOTAL_NEW

[1] "$b = -0.10$, 95\\% CI $[-0.29, 0.09]$"

$estimate$DAST_TOTAL_NEW

[1] "$b = 0.89$, 95\\% CI $[-0.10, 1.88]$"

$estimate$modelfit

$estimate$modelfit$r2

[1] "$R^2 = .37$, 90\\% CI $[0.28, 0.44]$"

$estimate$modelfit$r2_adj

[1] "$R^2_{adj} = .36$"

$estimate$modelfit$aic

[1] "$\\mathrm{AIC} = 1,787.29$"

$estimate$modelfit$bic

[1] "$\\mathrm{BIC} = 1,805.10$"

$statistic

$statistic$Intercept

[1] "$t(256) = 14.50$, $p < .001$"

$statistic$PIL_total

[1] "$t(256) = -11.63$, $p < .001$"

$statistic$AUDIT_TOTAL_NEW

[1] "$t(256) = -1.08$, $p = .283$"

$statistic$DAST_TOTAL_NEW

[1] "$t(256) = 1.77$, $p = .077$"

$statistic$modelfit

$statistic$modelfit$r2

[1] "$F(3, 256) = 49.58$, $p < .001$"

$full_result

$full_result$Intercept

[1] "$b = 57.65$, 95\\% CI $[49.82, 65.47]$, $t(256) = 14.50$, $p < .001$"

$full_result$PIL_total

[1] "$b = -0.40$, 95\\% CI $[-0.47, -0.33]$, $t(256) = -11.63$, $p < .001$"

$full_result$AUDIT_TOTAL_NEW

[1] "$b = -0.10$, 95\\% CI $[-0.29, 0.09]$, $t(256) = -1.08$, $p = .283$"

$full_result$DAST_TOTAL_NEW

[1] "$b = 0.89$, 95\\% CI $[-0.10, 1.88]$, $t(256) = 1.77$, $p = .077$"

$full_result$modelfit

$full_result$modelfit$r2

[1] "$R^2 = .37$, 90\\% CI $[0.28, 0.44]$, $F(3, 256) = 49.58$, $p < .001$"

$table

A data.frame with 6 labelled columns:

term estimate conf.int statistic df p.value

1 Intercept 57.65 [49.82, 65.47] 14.50 256 < .001

2 PIL total -0.40 [-0.47, -0.33] -11.63 256 < .001

3 AUDIT TOTAL NEW -0.10 [-0.29, 0.09] -1.08 256 .283

4 DAST TOTAL NEW 0.89 [-0.10, 1.88] 1.77 256 .077

term : Predictor

estimate : $b$

conf.int : 95\\% CI

statistic: $t$

df : $\\mathit{df}$

p.value : $p$

attr(,"class")

[1] "apa_results" "list" - Meaning: \(b = -0.40\), 95% CI \([-0.47, -0.33]\), \(t(256) = -11.63\), \(p < .001\)

- Alcohol: \(b = -0.10\), 95% CI \([-0.29, 0.09]\), \(t(256) = -1.08\), \(p = .283\)

- Drugs: \(b = 0.89\), 95% CI \([-0.10, 1.88]\), \(t(256) = 1.77\), \(p = .077\)

Overall Model Fit

- Is the overall model significant?

- \(R^2 = .37\), 90% CI \([0.28, 0.44]\), \(F(3, 256) = 49.58\), \(p < .001\)

Adjusted \(R^2\)

\[ \large R_{A}^2 = 1 - (1 -R^2)\frac{n-1}{n-p-1} \]

glance(model_fit) %>%

knitr::kable() %>%

kable_styling(font_size = 24) %>%

column_spec(2, color = "white",

background = "red")| r.squared | adj.r.squared | sigma | statistic | p.value | df | logLik | AIC | BIC | deviance | df.residual | nobs |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.3675175 | 0.3601056 | 7.438596 | 49.58476 | 0 | 3 | -888.6458 | 1787.292 | 1805.095 | 14165.17 | 256 | 260 |

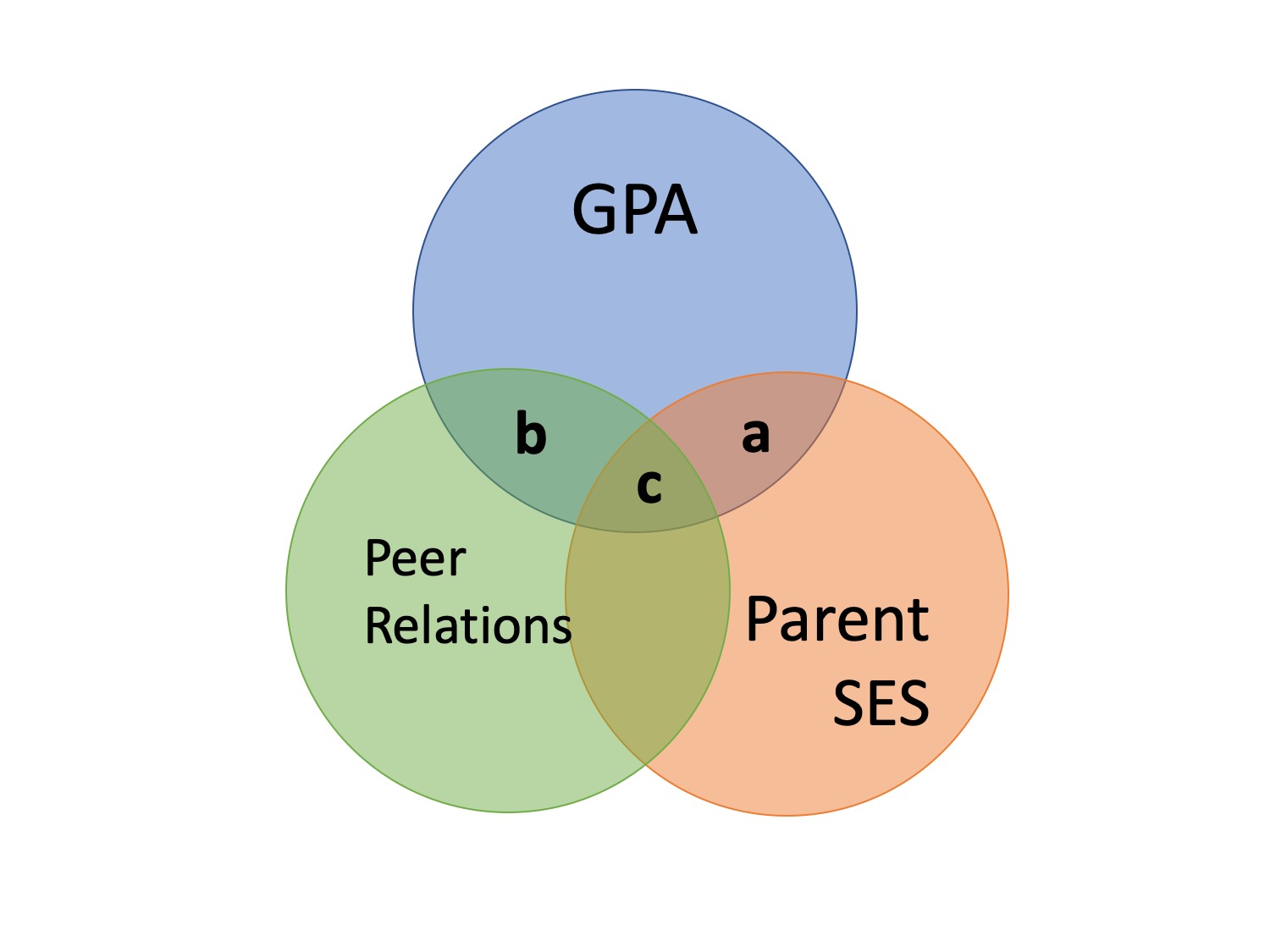

Effect size

- R is the multiple correlation

- \(R^2\) is the multiple correlation squared

- All overlap in Y used for overall model

- \(A+B+C/(A+B+C+D)\)

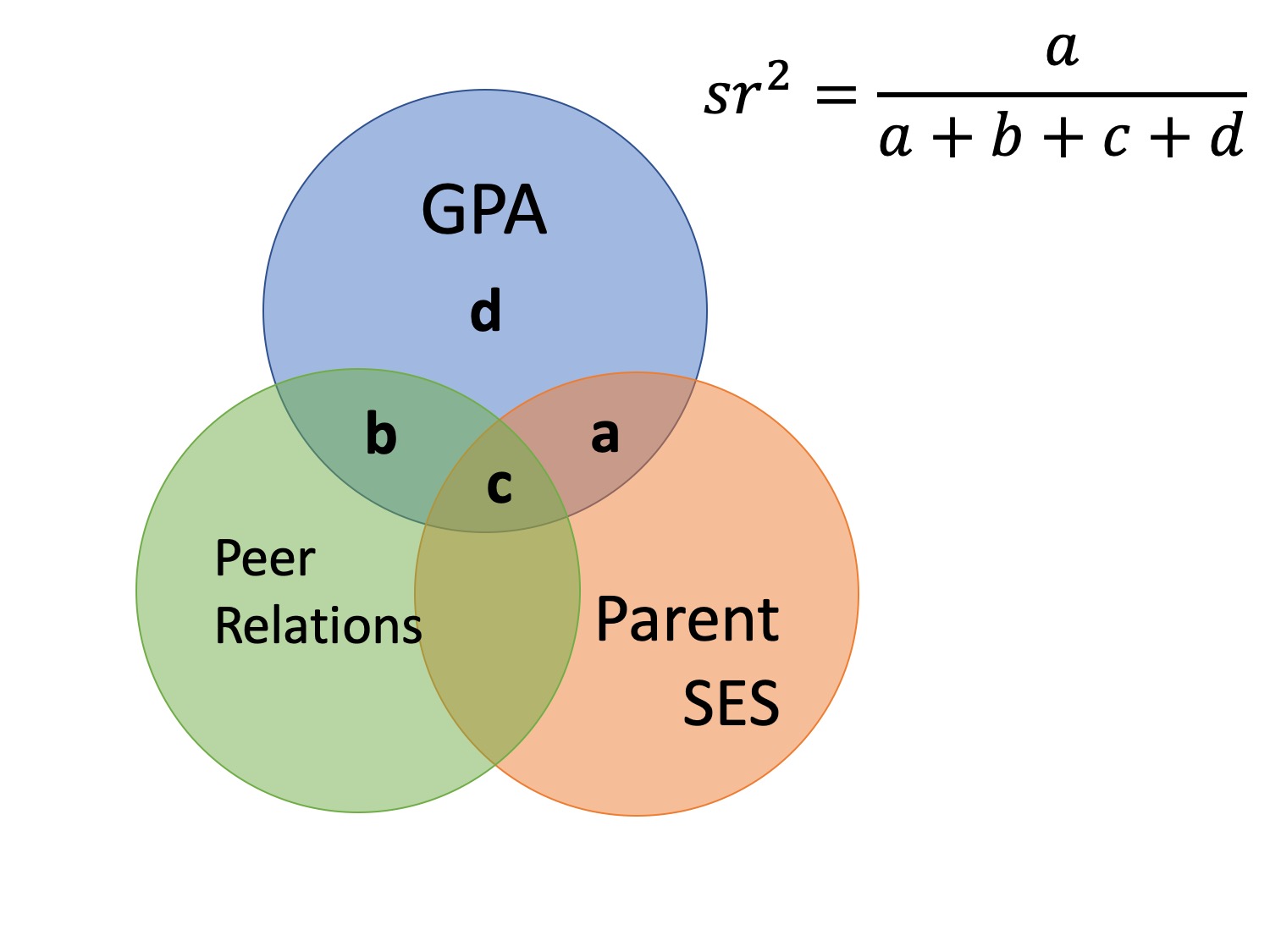

Effect Size

- sr is the semipartial correlation

- It represents (when squared) the proportion of (unique) variance accounted for by the predictor, relative to the total variance of Y

- Increase in proportion of explained Y variance when X is added

- How much does X add over and beyond other variables

- Increase in proportion of explained Y variance when X is added

- It represents (when squared) the proportion of (unique) variance accounted for by the predictor, relative to the total variance of Y

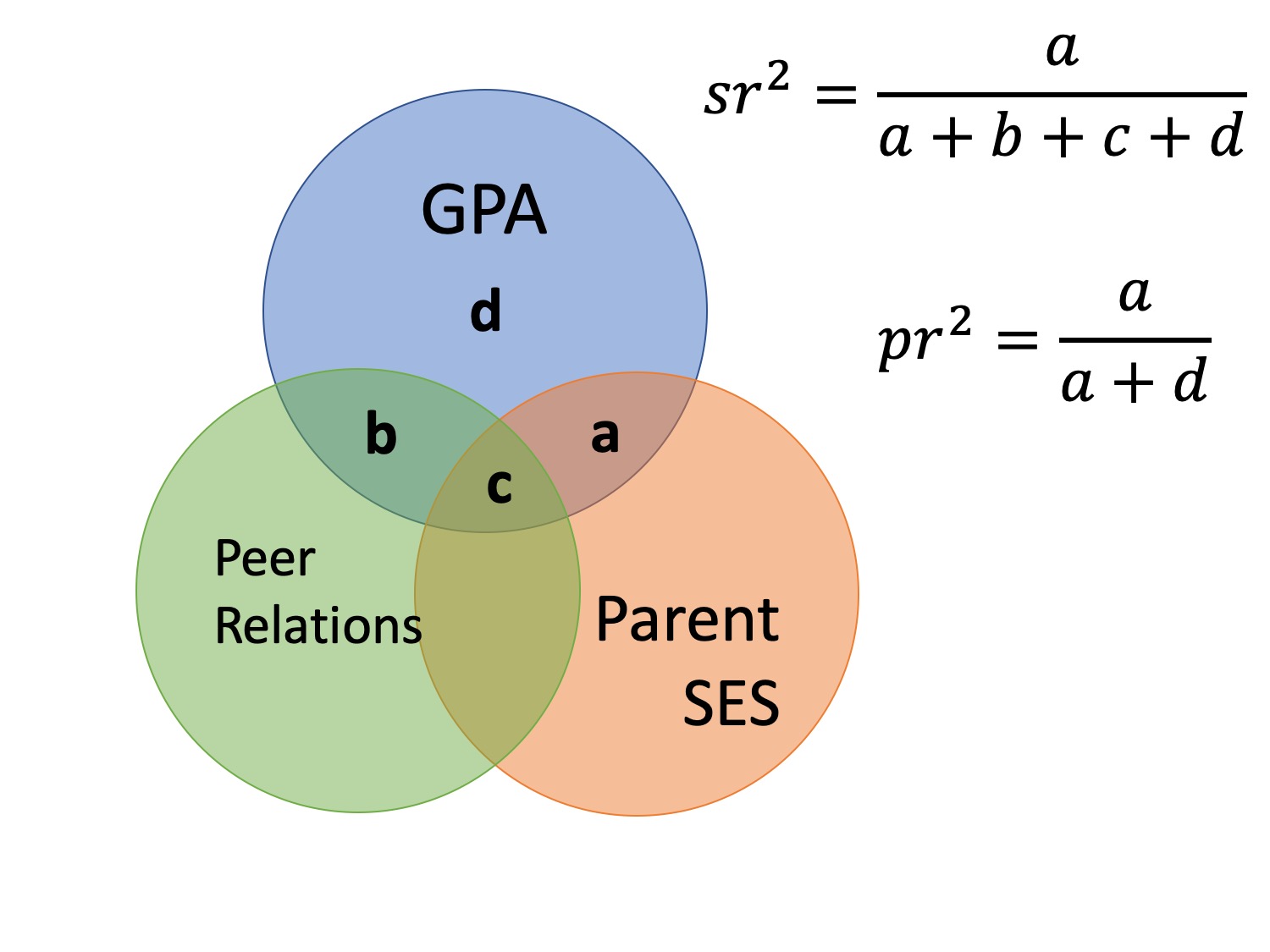

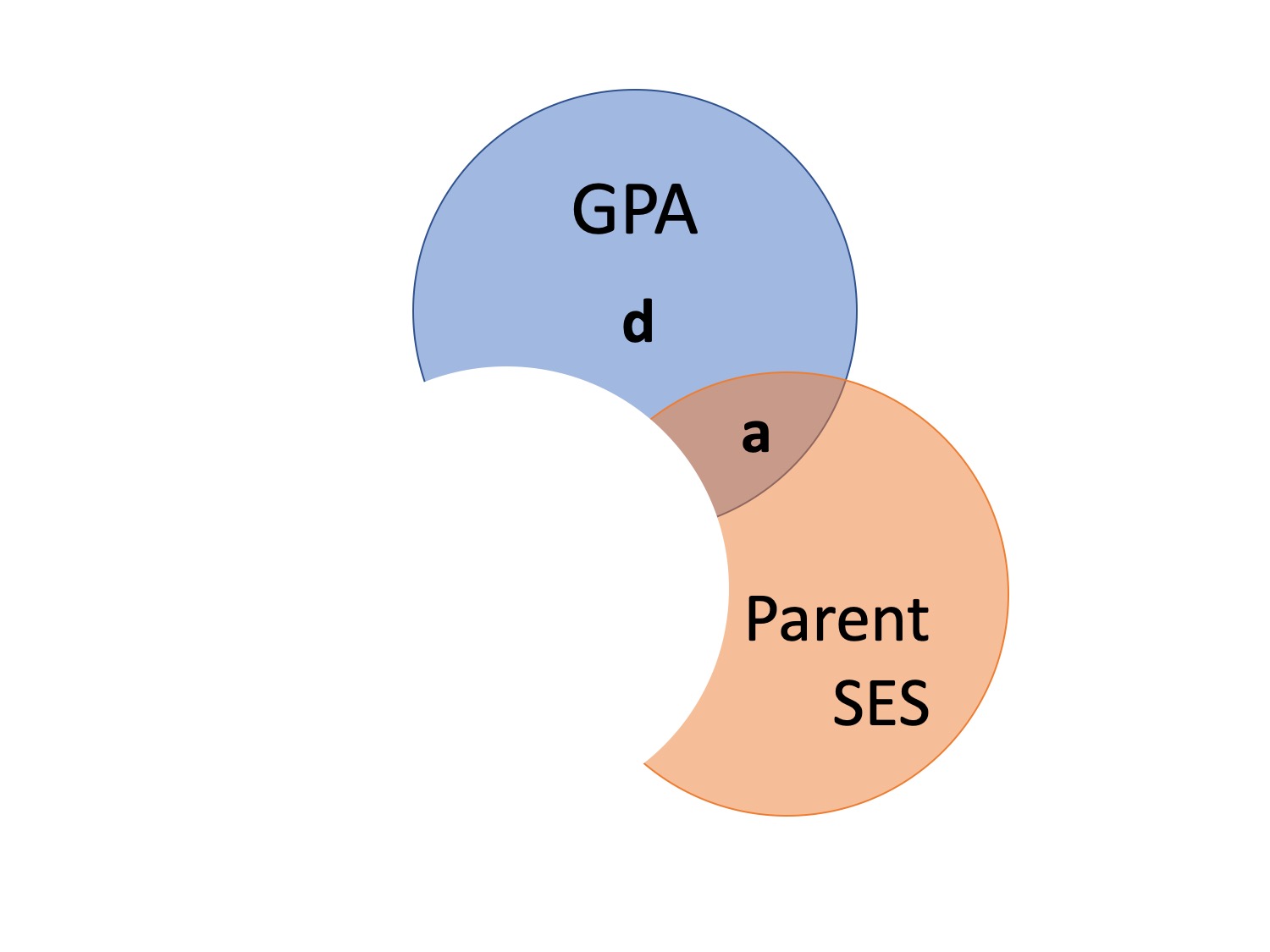

Effect Size

- \(pr\) is the partial correlation

- When squared, proportion of variance not explained by other predictors but just X

- Removes influence of other variables

- When squared, proportion of variance not explained by other predictors but just X

- Pr > sr

When to use?

\(sr^2\)

- Most often used when we want to show that some variable adds incremental variance in Y above and beyond another X variable

\(pr^2\)

- Remove influence of another variable

Partial correlations

PIL_total CESD_total AUDIT_TOTAL_NEW DAST_TOTAL_NEW

PIL_total 1.000000000 0.345595004 0.003207045 0.002944418

CESD_total 0.345595004 1.000000000 0.004507692 0.012149492

AUDIT_TOTAL_NEW 0.003207045 0.004507692 1.000000000 0.233954231

DAST_TOTAL_NEW 0.002944418 0.012149492 0.233954231 1.000000000Partial correlations

- Can use your model to get \(sr^2\)

Partial correlations

We would add these to our other reports:

- Meaning: \(b = -0.40\), 95% CI \([-0.47, -0.33]\), \(t(256) = -11.63\), \(p < .001\), \(pr^2 = .33\)`

- Alcohol: \(b = -0.10\), 95% CI \([-0.29, 0.09]\), \(t(256) = -1.08\), \(p = .283\), \(pr^2 = .02\)`

- Drugs: \(b = 0.89\), 95% CI \([-0.10, 1.88]\), \(t(256) = 1.77\), \(p = .077\), \(pr^2 = .03\)`

Note

\(pr^2\): 33% of variance in Depression is explained by meaning that is not explained by the other variables

\(sr^2\): 3% of variance in depression can be uniquely explained by meaning above and beyond the other vars.

Multiple Regression: Power

Plotting

Partial regression plots

- Must partial out other factors by setting them to some value (usually mean)

Write-up

We fitted a linear model(estimated using OLS) to predictCESD_total with PIL_total,AUDIT_TOTAL_NEW andDAST_TOTAL_NEW (formula:CESD_total ~ PIL_total +AUDIT_TOTAL_NEW +DAST_TOTAL_NEW). The model explains a statistically significant and substantial proportion of variance (R2 =0.36, F(3, 262) = 48.84, p <.001, adj. R2 = 0.35).

- Meaning: \(b = -0.40\), 95% CI \([-0.47, -0.33]\), \(t(256) = -11.63\), \(p < .001\), \(pr^2 = .35\)`

- Alcohol: \(b = -0.10\), 95% CI \([-0.29, 0.09]\), \(t(256) = -1.08\), \(p = .283\), \(pr^2 = .02\)`

- Drugs: \(b = 0.89\), 95% CI \([-0.10, 1.88]\), \(t(256) = 1.77\), \(p = .077\), \(pr^2 = .03\)`

Next Week

Centering

Standardizing

Transformations

PSY 503: Foundations of Statistics in Psychology